| The level of digitalisation on farms around the world varies widely. While some farms already rely on technologies such as artificial intelligence, the use of drones or robotics, others are still insufficiently digitalised. These are the findings of the “Agriculture in transition” study, which Continental conducted together with the market research institute Innofact AG in fall 2023. 503 farmers from five countries were asked about their daily work, their concerns and challenges. Digital solutions support farmers in the necessary transformation towards sustainable and efficient agriculture. Precision farming is a good example. It uses GPS, sensors and data analysis to more precisely manage resources such as fertiliser, water and pesticides. This optimises field management, protects the soil, and increases farm efficiency, value, and sustainability.

“We are currently experiencing a profound change in agriculture, driven primarily by connectivity, robotics and artificial intelligence. At the end of this transformation, agriculture will not only be more efficient but also more environmentally friendly. We see the potential to transform the entire value chain. The results of our ‘Agriculture in transition’ study show that farmers also see this potential. Ismail Dagli, Head of the Autonomous Mobility and Commercial Vehicles business unit at Continental, states that our goal is to work closely with farmers to strategically harness technological advances and make agriculture more resilient to climate change.

Farmers are at different stages of digital transformation

The majority of respondents are currently using digital solutions. 79 per cent already use such technologies today, and more than two-thirds of farmers say that digitalisation plays a rather relevant role in their daily work (71 per cent). Nevertheless, there are major differences between regions and company sizes.

In Germany, France and the U.S., about 13 per cent of farmers do not use digital technologies, while in Brazil it is only one in twenty (5 per cent). In Japan, however, around 60 per cent of respondents state that they carry out their agricultural work without digital applications.

This also has an impact on the level of satisfaction with the digitalisation of one’s farm. In an international comparison, Japanese farmers are the least satisfied with their level of digitalisation. Around 77 per cent of them state that they do not use enough technologies (international average: 37 per cent). Conversely, German farmers are the most satisfied with how digital technologies are utilised on their farms. About two-thirds (67 per cent) say they use just the right amount (international average: 54 per cent). These results make it clear: regardless of whether respondents are currently satisfied with their use of technology or not, the road to the digital farm is still a long one.

The size of the farm also confirms this. In general, the smaller the farm, the less digitalised it is. On farms with less than 50 hectares of land, about 20 per cent say they do not use any digital technologies. The figure is twelve per cent for farms between 100 and 200 hectares, and ten per cent for farms over 200 hectares.

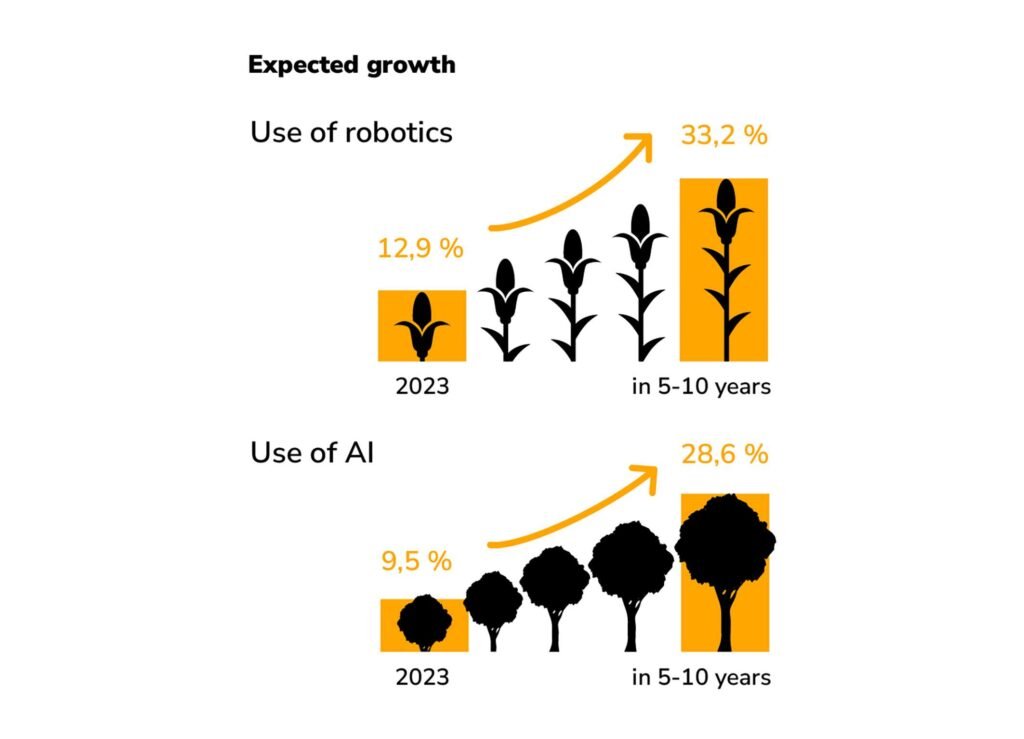

Among those using digital technologies, a look at the level of digitalisation also reveals big differences: While many farmers have already implemented solutions such as apps and GPS-controlled agricultural machinery (apps: 45 per cent, GPS-controlled agricultural machinery: 41 per cent) and almost one in three farmers (30 per cent) use satellite images, the use of robotics (13 per cent) and artificial intelligence (10 per cent) is less widespread. However, the use of drones is already becoming more popular: More than one in four farmers (27 per cent) use drones, primarily to analyse land from the air.

Robotics use expected to double, AI applications expected to triple

There is no question that the use of digital applications will increase. However, the digital gap is likely to widen. About one in four farmers (24 per cent) still have no concrete idea what technologies will be used on their farms in the future. “Farmers around the world are facing increasing challenges: growing demand for food, increasing regulations, and visible effects of climate change. Besides politicians, who can set the framework, it is also up to technology suppliers to meet these demands with durable and environmentally friendly technologies,” explains Mario Branco, Head of Off-Highway at Continental.

On the other hand, technologies that are not widely used today will become more important: One-fifth (20 per cent) of farmers who are not using robotics today expect to do so within the next five to ten years. By then, one-third of farmers would be using robotic solutions. This represents an increase of 138 per cent – more than a doubling. The percentage is particularly high in Germany (28 per cent), the U.S. (27 per cent) and Brazil (24 per cent). Expectations are lowest in Japan, at 9 per cent.

A similar trend is seen in artificial intelligence, where farmers predict even greater growth. Respondents expect this number to triple in the next five to ten years. While an average of 10 per cent of respondents are using AI today, an additional 19 per cent expect to begin using AI during this period. Only Germany and Brazil have higher percentages at 26 per cent (Germany) and 25 per cent (Brazil). The U.S. on the contrary, has the lowest expectations, at around 13 per cent.

“In the coming years, many farmers will significantly increase their use of artificial intelligence and robotics to make their operations more efficient and environmentally friendly, including the use of pesticides and herbicides. This will fundamentally change the way farming is done, from precise soil analysis to automated harvesting to intelligent yield prediction. We are already contributing importantly to our greenhouse robotic solution and our new herbicide-free Weed Control System. At the same time, we at Continental are supporting our customers in every step of the implementation to ensure that they can fully benefit from the potential of these technologies,” says Mario Branco, Head of Off-Highway at Continental.

Technology companies must address the individual digital needs of farmers

The study proves that farmers need powerful partners for change. When asked what (additional) services from technology companies would help them, 43 per cent of respondents said more user-friendly technologies. 37 per cent are interested in training courses on the usability of technologies provided, while 31 per cent would like to see data presented comprehensively.

“If technology companies like Continental want to support farmers in their digital transformation, they need to address the individual challenges they face at each stage of their digital transformation,” says Mario Branco. Taking into account regional differences in technology availability, farm size and type, local infrastructure and technologies already in use, farmers need customised and intuitive digital solutions. In developing these solutions, the global technology company is drawing on its expertise in intra-logistics, construction and mining, as well as passenger cars and commercial vehicles, and incorporating its knowledge of materials, big data, automation, and sensors into its solutions for agriculture.